open-end credit meaning and example

A type of revolving account that permits an individual to pay on a monthly basis only a portion of the total amount due. Membership or Participation Fees.

An open-end mortgage allows you to access your home equity and use the funds as necessary.

. Definition and Example of an Open-Ended Account. The 3 main types of credit are revolving credit installment and open credit. An example of this would be a cellphone bill you can make phone calls.

If approved you will be able to borrow additional funds on the same loan amount up to a limit established by the lender. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score. A line of credit generally arranged before the funds are actually required provides flexibility for the customer in that it ensures the ability to meet short-term cash needs as they arise.

Having a fluctuating capitalization of shares that are issued or redeemed at the current net asset value or at a figure in fixed ratio to this. Open-end credit also called revolving credit can be defined as a line of credit that gives the borrower a certain limit of credit and the ability to frequently borrow as little or as much of that money and repay any amount utilized below the set limit within a specified period. Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments.

Credit enables people to purchase goods or services using borrowed money. A credit arrangement in which a financial institution agrees to lend money to a customer up to a specified limit. The pre-approved amount will be set out in the agreement between the lender and the borrower.

A secured credit card and home equity line. Definition and Examples of an Open-End Mortgage. That might be a bit too complicated so well try.

Unlike a credit card which is an excellent example of an open-end loan closed-end loans do not allow borrowers to continually access new funds when they have paid back a portion of the original borrowed amount. Triggered Terms 102616 b. Credit card accounts home equity lines of credit HELOC and debit cards are all common examples of open-end credit though some like the HELOC have finite payback periods.

Similar to a credit card limit but you are required to pay the funds borrowed in full at the end of each period. The mortgagee may secure additional money from the mortgagor lender through an agreement which typically stipulates a maximum amount that can be borrowed. Transactions that exceed the pre-approved limit are typically declined and not processed.

Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time. An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed. Also called bank line credit line.

This type of Consumer Credit is frequently used in conjunction with bank and department store credit cards. Up to 10 cash back The Basics of Closed-End Credit. A pre-approved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments coming due.

However by establishing an open-end credit account with a limit of at least 500 the consumer would save the additional 159 annually in premiums assuming no transaction costs to opening the account would only need to exercise the credit option in the event of a loss and could extend the repayment over three years or more. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. The issuing bank allows the consumer to utilize borrowed funds in exchange for the promise to repay any debt in a timely manner.

If the plan provides for a variable rate that fact must be disclosed. In the case of a credit card account under an open end consumer credit plan under which a late fee or charge may be imposed due to the failure of the obligor to make payment on or before the due date for such payment the periodic statement required under subsection b with respect to the account shall include in a conspicuous location on the. Monitor Your Experian Credit Report Get Alerts.

Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment. You must pay a low minimum balance by the due date.

A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. Terms in this set 9 Open end credit. Once the funds have been transferred to the borrower they must be paid back entirely to satisfy the terms of the borrowing agreement and conclude.

To understand it better a line of credit as used in the. Ad 90 Of Top Lenders Use FICO Scores. Examples include credit cards home equity loans personal lines of credit and overdraft protection on checking accounts.

Keep in mind your borrowing limit depends on your homes value and the amount of your first mortgage. The definition of an open-end mortgage underlines the fact that the mortgage or trust deed can be increased by the mortgagee borrower. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR.

Permitting additional debt to be incurred under the original indenture subject to specified conditions. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of open-end credit. Adjective organized to allow for contingencies.

Open-ended accounts have pre-approved credit limits that allow you to carry an outstanding revolving balance at any given time.

Understanding Different Types Of Credit Nextadvisor With Time

/letter-of-credit-474454659-ac5d6f45ce244478af87f92f1392884c.jpg)

Standby Letter Of Credit Sloc Definition

Sales Journal Entry Cash And Credit Entries For Both Goods And Services

How To Use A Credit Card Best Practices Explained Valuepenguin

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

What S The Difference Between Credit Debit Cards Huntington Bank

How To Improve Your Credit Age Of Credit History Credit Com

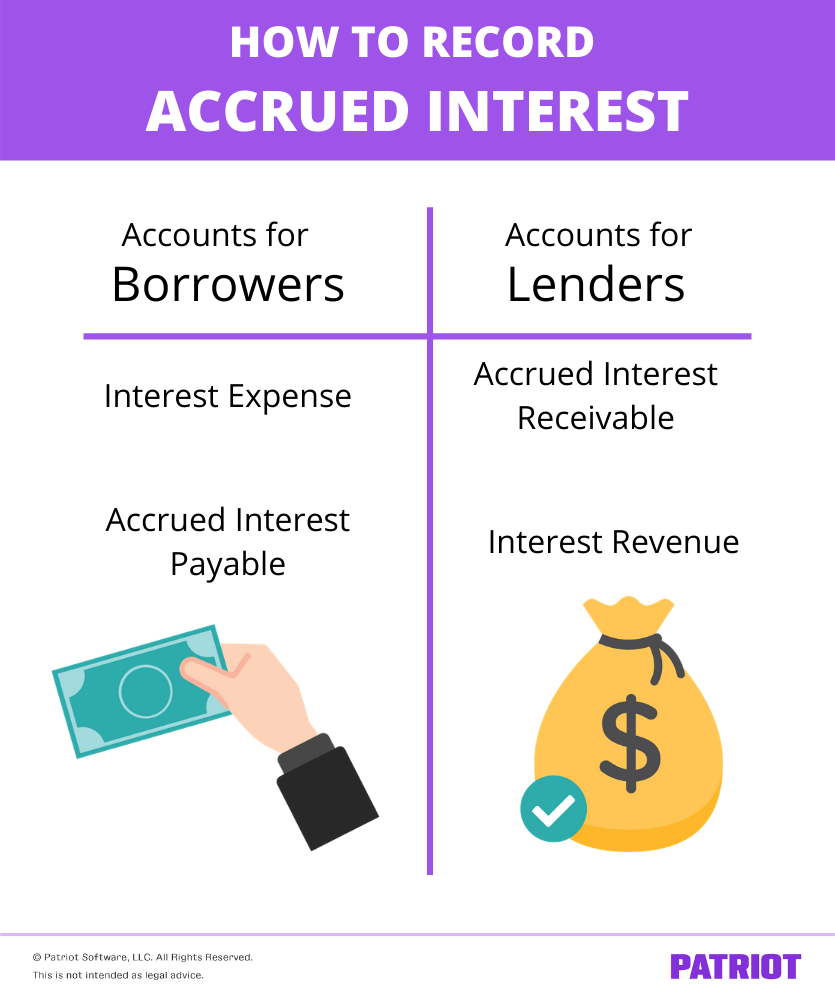

How To Record Accrued Interest Calculations Examples

What Is A Good Credit Score Forbes Advisor

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What Is A Secured Card And How Does It Work Capital One

Letter Of Credit Guide On Types Process Example

How To Use A Credit Card Best Practices Explained Valuepenguin

/T-Account_2-cf96e42686cc4a028f0e586995b45431.png)

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)